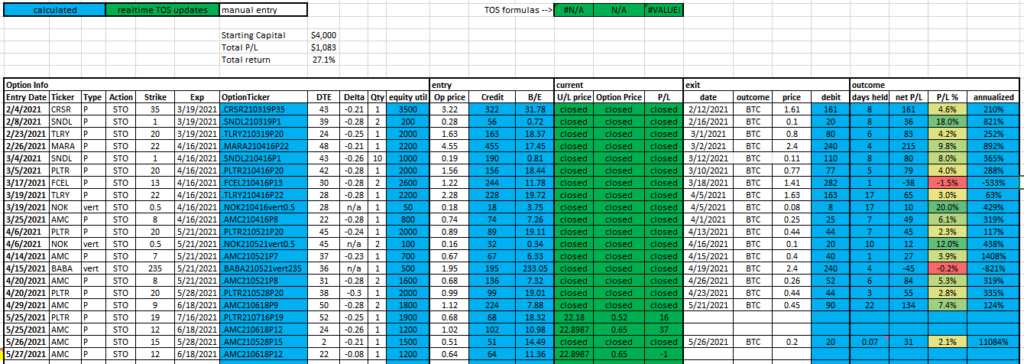

Introduction to the Wheel Options Trading Strategy

More to come here later. Getting this post up so I can put links to the Wheel Options Trading Strategy tracker itself as requested by r/ThetaGang as well as the ThinkOrSwim reference.

I put together a YouTube video going over this tracker and how it works – https://youtu.be/aSnyv3jbtuA. Watch the video then come back here to download the tracker itself (download link at the bottom of the post).

In short, this trading strategy to to sell cash secured puts on tickers you wouldn’t mind owning. As theta (time) goes on, the options price decreases (with everything else held constant) so you can buy back the put at a lower price. This is a neutral to bullish options strategy. It should not be used if you are bearish on a ticker.

7 replies on “The Wheel Options Trading Strategy”

Thank you so much for this Austin. I am a 30-year investor and this is a revelation to me.

*I mean the spreadsheet being able to import real time TOS data. That is just stupefying!

It really is amazing what you can do with market data these days!

Thanks Austin, this is lifesaver. The best part is it’s free and better than most sold spreadsheet out there. Thanks for what you do man.

Btw, can this be used as credit spread? if not, i would love to have one if it’s available.

Thanks again.

I am new at this. So, I am trying everything. TD Ameritrade limited me to only cash-secured puts and covered calls.

The cash-secured puts are my main focus.

Raymond, Keeping it simple with covered calls and cash-secured puts … they will serve you well. Recommend utube Markus Heitkoetter to learn about selling these simple options called the Wheel Strategy.